What to Do if a Friend Never Pays for Anything

Covering for a friend once is normal. Covering every time quickly becomes a problem. When one person never pays, frustration builds and friendships get tested.

This situation is more common than people admit. Handling it poorly creates drama. Handling it clearly protects both your money and the relationship.

This article explains why it happens and how to deal with it without escalating things.

Why This Situation Usually Happens

Most people who never pay are not trying to cause conflict. The reasons vary, and how you respond should depend on what’s actually going on.

Common Reasons:

• Genuine financial constraints

• Forgetfulness or disorganization

• Different cultural attitudes toward money

• Assumption that others don’t mind paying

• Intentional freeloading behavior

Not every case is the same. Understanding the pattern helps you choose the right response.

Warning Signs:

• Always “forgets” wallet or payment method

• Suggests expensive places but doesn’t pay

• Makes excuses when bills arrive

• Orders generously but disappears at payment time

• Promises to pay later but never follows through

Once these signs repeat, the issue is no longer accidental.

Strategies That Work

Ignoring the behavior rarely fixes it. These approaches address the issue without creating unnecessary tension.

1. Have a Direct Conversation

Start with clarity, not accusation. Many people are unaware of the impact of their behavior.

Script: “Hey, I’ve noticed I’ve been covering more often lately. Can we make sure we split things evenly going forward?”

Direct conversations work best early, before resentment builds.

2. Set Payment Expectations Upfront

Collect money before plans begin. This removes ambiguity and prevents awkward moments later.

Example: “The dinner is €30 per person. Can everyone send their share before Friday?”

This works especially well for group plans or recurring activities.

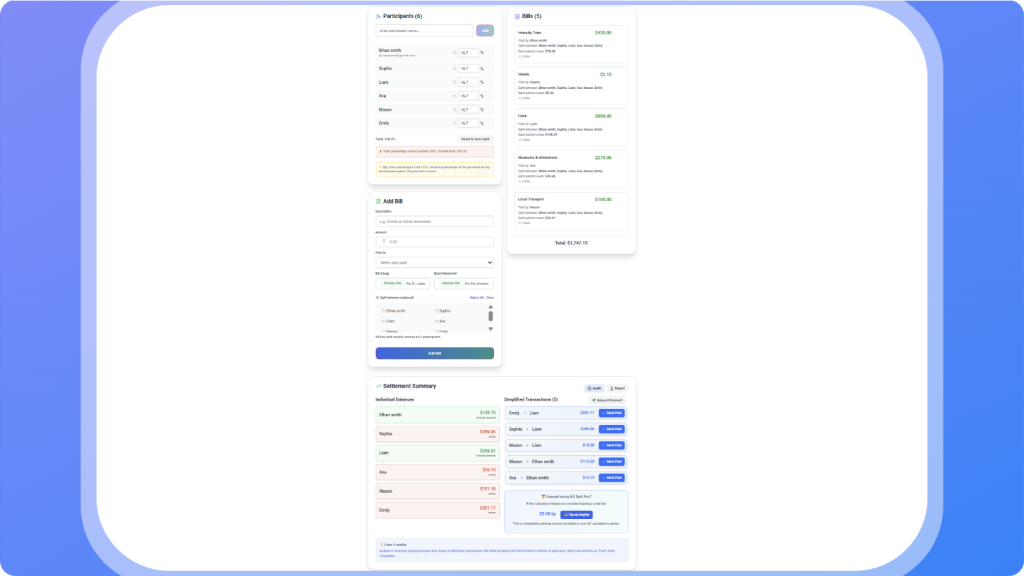

3. Use Transparent Expense Tracking

When contributions are visible, people are more likely to follow through.

Benefit: Shared tracking removes the need for reminders and keeps things factual. If someone consistently does not pay, the pattern becomes clear without confrontation.

4. Limit Expensive Group Activities

If the behavior continues, adjust the setting.

Example: Choose activities where everyone pays individually, or reduce invitations to situations where one person covering the group is expected. This protects you without calling anyone out publicly.

When It’s Time to Set Boundaries

If clear communication does not change behavior, firmer boundaries are necessary. This is about fairness, not punishment.

⚠️ Red Flags That Require Boundaries:

• Payment avoidance continues after direct conversations

• Excuses replace action

• One person repeatedly benefits from others’ generosity

• The topic triggers defensiveness instead of cooperation

• There is no sign of reciprocity

At this point, continuing to cover costs teaches the behavior to continue.

Protecting the Group Dynamic

One non-payer affects everyone. Others start resenting the situation, even if they do not say it out loud.

Clear systems like Bill Split Pro reduce pressure on individuals. When expectations are shared and payments are visible, accountability happens naturally and quietly. This protects the group without singling anyone out.

👨🔬

Editor’s Take

"When a friend never pays, I try to address it calmly instead of letting frustration build. Ignoring it only creates resentment. Sometimes I even make a light joke about it to ease the tension, then follow up with a simple, honest comment so it doesn’t turn into a bigger issue later." - Martynas Baniulis

Final Words

A friend who never pays creates imbalance, whether intentional or not. Ignoring it rarely fixes the issue.

Address patterns early. Be clear about expectations. Set boundaries if behavior does not change.

Fairness protects friendships. Silence usually does the opposite.

🤝

Create Fair, Transparent Expense Sharing

Use Bill Split Pro's transparent tracking to ensure everyone contributes fairly. Visibility creates natural accountability.