Should You Round Up Bills When Splitting with Friends?

Rounding up a bill can feel harmless. It speeds things up, avoids small change, and sometimes feels more generous. But over time, those small round-ups can add real imbalance.

What works once does not always work as a habit. The right choice depends on amounts, frequency, and group expectations.

This article explains when rounding up shared bills makes sense, when it causes problems, and how to use it without creating quiet frustration.

Why People Round Up Shared Bills

Rounding up is often used to keep things simple. It avoids small change, speeds up payments, and can feel like a small gesture of goodwill. In casual situations, this can work well. In others, it can quietly shift costs over time.

Understanding when rounding helps and when it causes imbalance makes the difference.

The Case for Rounding Up

Rounding up makes payments simpler and can show generosity, especially for small amounts or when dealing with cash payments.

✅ Benefits of Rounding Up:

• Eliminates dealing with small change

• Shows generosity and goodwill

• Simplifies digital payments

• Covers small forgotten expenses

• Makes mental math easier

When NOT to Round Up

Rounding isn’t always appropriate, especially when amounts are large or when some group members are budget-conscious.

❌ Avoid Rounding When:

• Individual amounts are large (over $50)

• Some group members are on tight budgets

• The group prefers exact calculations

• Rounding would add significant cost

• You’re tracking expenses for reimbursement

Smart Rounding Strategies

If rounding is used, it helps to follow simple rules that keep things fair.

The $5 Rule

Round to the nearest $5 for amounts under $50, exact amounts for larger bills.

Example: $23.47 becomes $25, but $67.23 stays $67.23

The Consensus Approach

Ask the group if they want to round up before doing calculations.

Script: “Should we round up to make payments easier, or stick to exact amounts?”

The Tip Buffer

Use rounding as a way to ensure adequate tipping rather than just convenience.

Example: Round up to ensure the tip reaches 20% instead of 18.5%

Digital Payment Considerations

With digital payments, exact amounts are easy to send. There is no need to round to avoid coins or cash change, which means rounding becomes a choice rather than a necessity.

This matters for groups that split expenses often. Small round-ups that feel harmless once can add up over time, especially if the same people consistently round.

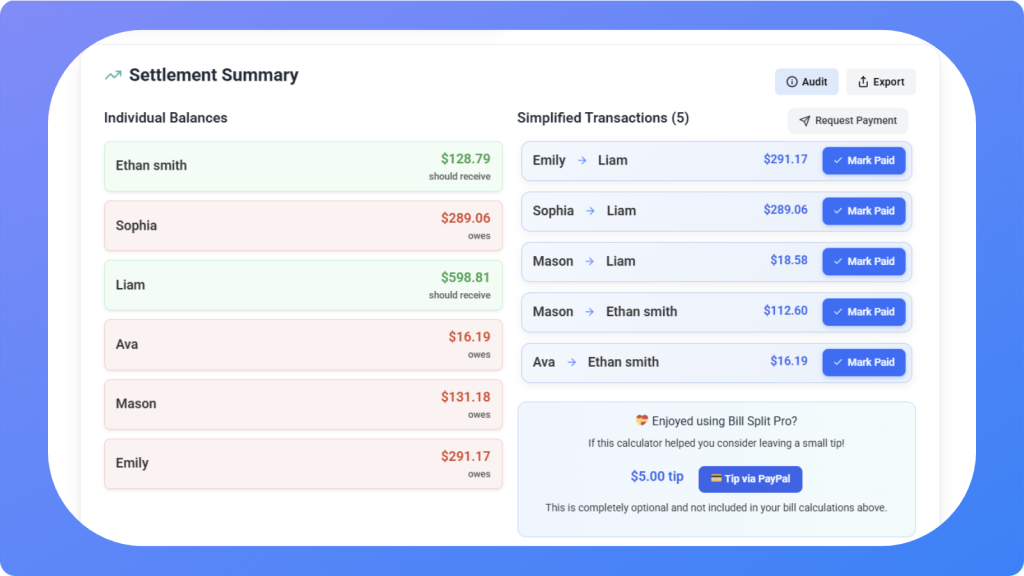

Using a shared bill split calculator makes exact splits simple, even for small amounts. Everyone sees the same numbers, which removes the need to round for convenience.

For recurring expenses, exact amounts usually feel fairer. If rounding is used with digital payments, it should be agreed on upfront and applied evenly so no one feels they are covering extra costs without realizing it.

👨🔬

Editor’s Take

"I mostly pay with a credit card, so there’s no real reason to round up bills. Even beyond that, I don’t think rounding makes much sense when splitting with friends. Exact amounts are easy to handle, so I prefer keeping it precise." - Martynas Baniulis

Final Words

Rounding up should be a choice, not an assumption. It works best for small amounts, one-time expenses, or situations where everyone agrees upfront.

Avoid rounding when costs are large or recurring. Small differences add up quickly when the same people always round.

When in doubt, ask. Clear agreement keeps rounding generous instead of unfair.

🔢

Round Smart, Split Fair

Whether you round up or use exact amounts, Bill Split Pro handles both approaches for fair group expense sharing.

Your Choice