Should Couples Split Bills 50/50?

Couples often assume there is a correct way to split bills. In reality, what works depends on income, habits, and how both partners view fairness.

A strict 50/50 split can feel right for some couples and completely wrong for others. The issue is not equality on paper, but balance in real life.

This article looks at whether couples should split bills 50/50 and when other approaches make more sense.

How Couples Usually Approach Shared Expenses

Couples tend to handle shared expenses in a few common ways. Some prefer a clean 50/50 split, others adjust based on income, and many mix approaches depending on the type of expense. What feels fair often changes as relationships and responsibilities evolve.

Understanding these approaches helps frame the discussion before deciding what works best in practice.

The Case for 50/50 Splitting

Equal splitting treats both partners as equals in responsibility, regardless of income differences. This approach emphasizes partnership and shared responsibility.

✅ Benefits of 50/50 Splitting:

• Simple and straightforward to calculate

• Promotes equal partnership mentality

• Avoids complex income discussions

• Encourages both partners to be cost-conscious

• Works well when incomes are similar

The Case for Income-Based Splitting

✅ Benefits of Income-Based Splitting:

• Accounts for different financial capacities

• Reduces financial stress on lower earner

• Allows for higher lifestyle without burden

• Promotes long-term financial harmony

• Reflects how many couples manage shared finances today

Factors to Consider

Before choosing a splitting method, it helps to look at a few practical factors that shape what feels fair in a relationship.

Income Disparity

Relationship Stage

Early relationships often use 50/50 splitting for simplicity. Long-term partnerships may evolve toward income-based or hybrid approaches.

Financial Goals

Consider how splitting affects each partner’s ability to save, invest, or pursue personal financial goals. A split that limits one partner’s ability to save can cause imbalance over time.

Lifestyle Preferences

Hybrid Approaches That Work

Many successful couples use different splitting methods for different types of expenses:

🏠 Example Hybrid System:

• Housing & Utilities: Split proportionally by income

• Groceries & Household: Split 50/50

• Dining Out: Take turns paying or split 50/50

• Personal Items: Individual responsibility

• Vacations: Discuss case-by-case

👨🔬

Editor’s Take

"In my family, I focus on providing financially, while my wife focuses on our family and home. Because of that, a strict 50-50 split would never make sense for us. We share responsibilities differently, so our finances reflect that." - Martynas Baniulis

Keeping Splits Clear Over Time

What matters most is not choosing the perfect method once, but keeping the split clear as life changes. Incomes shift. Habits change. Expenses stop being predictable.

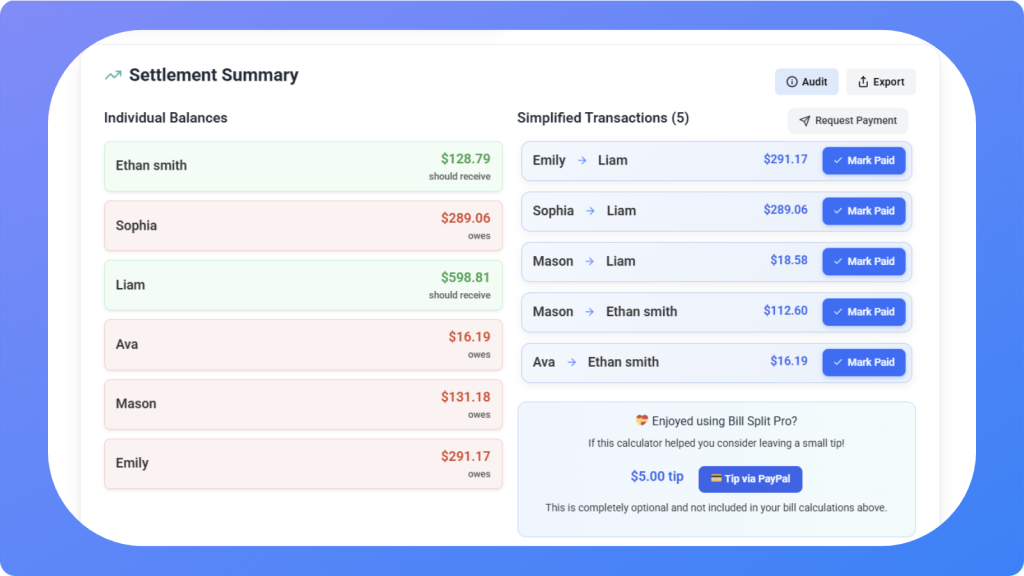

Using a shared expenses calculator helps couples keep everything visible in one place. Both partners see expenses, balances, and how costs are divided without revisiting old conversations.

When the numbers stay clear, discussions stay calm. The focus stays on the relationship, not on tracking who owes what.

Final Words

There is no universal rule for couples and money. Fairness depends on income, lifestyle, and shared goals.

Choose a system both partners are comfortable with. Review it as circumstances change. Adjust without keeping score.

When both people feel respected, the agreement matters more than the split itself.

💕

Find Your Fair Splitting System

Whether you choose 50/50 or income-based splitting, Bill Split Pro makes it easy to track and calculate fair shares.