How Should Bills Be Split in a Marriage

Money habits shape daily life in a marriage. When expectations are unclear, even routine bills can create tension over time.

There is no single system that works for every couple. Income levels, spending styles, and long-term plans all play a role. What matters most is choosing a setup both partners understand and accept.

This article explains how married couples usually split bills and how to decide what fits your relationship.

How Married Couples Usually Handle Shared Bills

Most couples fall into problems not because of money itself, but because they never define how bills are handled. Some assume everything is shared. Others expect independence. The mismatch shows up slowly, then explodes.

In practice, married bill splitting usually follows one of a few clear patterns. Each comes with trade-offs that affect fairness, autonomy, and long-term stability.

Communication Comes Before Any System

Before choosing a method, couples need clarity around money expectations. Skipping these conversations causes friction no matter which system you pick.

💬 Essential Money Conversations:

• Individual financial goals and priorities

• Comfort levels with different spending amounts

• Existing debts and financial obligations

• Career plans and potential income changes

• Family financial support expectations

Strong systems fail without honest communication.

The Three Common Ways Married Couples Split Bills

Most couples use one of these approaches, or a variation of them.

1. Complete Financial Merger

All income goes into shared accounts. All expenses are paid jointly.

Best For:

• Spending habits are similar

• Financial goals are aligned

• Both partners value simplicity and transparency

Challenges:

• Less personal spending autonomy

• Tension over individual purchases

• Harder to maintain financial independence

This approach is simple, but not flexible.

2. Proportional Contribution System

Each partner contributes to shared expenses based on income. Personal spending stays separate.

How It Works:

If Partner A earns $60k and Partner B earns $40k (total $100k):

• Partner A contributes 60% to shared expenses

• Partner B contributes 40% to shared expenses

• Personal spending remains individual

Benefits:

• Reflects earning capacity

• Maintains individual financial freedom

• Accounts for income differences

• Preserves individual control

This system balances fairness with independence.

3. Hybrid Approach

Combine different methods for different types of expenses. Many successful couples use this flexible approach.

Common hybrid setup:

• Housing & Utilities: Proportional by income

• Groceries & Household: Split 50/50

• Dining Out: Take turns or split equally

• Personal Items: Individual responsibility

• Savings Goals: Proportional contributions

This approach adapts well as life changes.

What Bills Are Usually Shared in a Marriage

Defining shared expenses removes constant negotiation.

🤝 Typically Shared in Marriage:

• Housing costs (rent/mortgage, utilities)

• Groceries and household supplies

• Insurance premiums

• Joint savings and retirement goals

• Family expenses and childcare

• Shared transportation costs

Shared bills should be predictable and agreed upfront.

👤 Often Kept Individual:

• Personal hobbies and interests

• Individual clothing and accessories

• Personal debt from before marriage

• Individual professional expenses

• Personal gifts for friends/family

• Individual entertainment subscriptions

Keeping these separate prevents resentment.

Factors That Should Influence Your Decision

The “right” system depends on your situation.

Income Differences

Financial Goals

Consider how your splitting method affects each partner’s ability to save, invest, or pursue personal financial goals. The system should support both individual and joint objectives.

Career Stages

Family Background

Cultural and family backgrounds influence expectations about money in marriage. Discuss these differences openly to find an approach that honors both perspectives.

Common Marriage Bill Splitting Scenarios

💑 Scenario 1: Similar Incomes

Both partners earn similar amounts and prefer simplicity.

Recommended: 50/50 splitting for all shared expenses. Simple, fair, and easy to manage.

💰 Scenario 2: Income Disparity

Partner A earns $80k, Partner B earns $40k.

Recommended: Proportional splitting (67%/33%) for major expenses, equal splitting for smaller items.

🏠 Scenario 3: One Stay-at-Home Partner

Recommended: Working partner covers most expenses, but both have access to personal spending money.

Setting Up a System That Actually Works

A good system removes daily friction and keeps money discussions from becoming emotional. Clarity matters more than the exact method you choose.

🛠️ Implementation Tips:

• Set up automatic transfers for shared expenses

• Use shared accounts for joint expenses

• Maintain individual accounts for personal spending

• Schedule regular financial check-ins

• Plan for major purchases together

• Review and adjust your system as needed

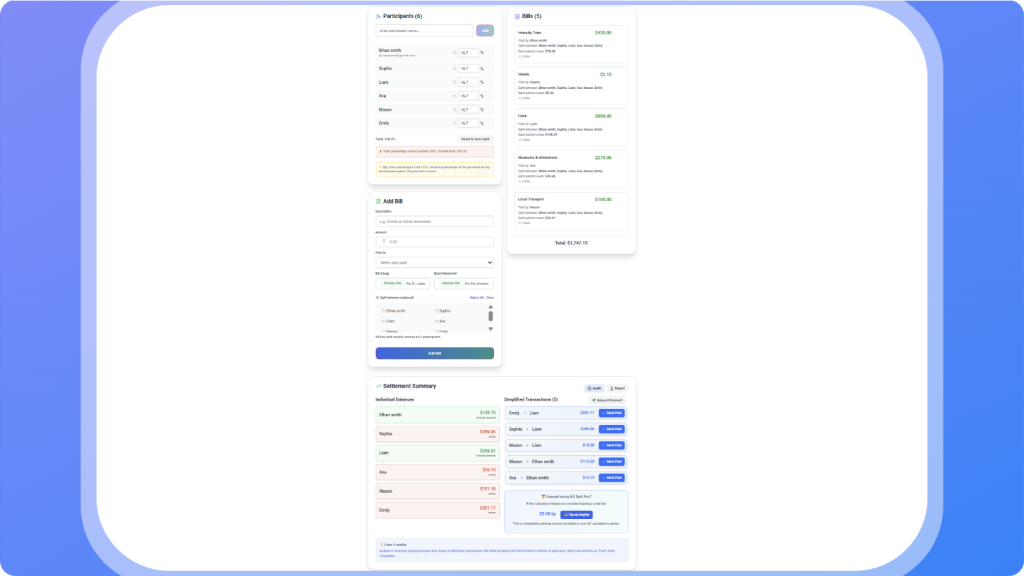

Tracking shared bills in one place, such as a simple bill split calculator, helps both partners see the same numbers and avoid misunderstandings.

Handling Financial Changes

Marriage finances evolve over time. Job changes, career advancement, children, and life circumstances all affect your financial arrangement. Build flexibility into your system.

Career Changes

When one partner gets a promotion or changes jobs, discuss whether your splitting arrangement should adjust to reflect new income levels.

Adding Children

Children bring new expenses and may require one partner to reduce work. Plan how childcare costs and reduced income will affect your system.

Major Life Events

Home purchases, health issues, or family emergencies may require temporary adjustments to your normal bill splitting arrangement.

👨🔬

Editor’s Take

"In a marriage, I think bill splitting depends on roles and agreement. In our case, there are certain categories I take care of and others my wife handles. I don’t mind 50-50 or income-based splits as long as both sides feel it’s fair and works for the family." - Martynas Baniulis

Final Words

There is no right or wrong way to split bills in a marriage. Fair looks different for every couple.

The best system is one that feels balanced, supports shared goals, and leaves room for individual needs. What works now may change later, and that is normal.

Talk openly. Review your setup regularly. Adjust as life changes.

Clear expectations turn money from a source of stress into a shared responsibility.

💕

Strengthen Your Financial Partnership

Whether you choose joint finances or proportional splitting, Bill Split Pro can help you track and understand your spending patterns.