How Couples Living Together Can Manage Shared Bills

Living together means sharing daily costs. Rent, utilities, food, and subscriptions quickly become joint decisions. If expectations are unclear, small bills can turn into recurring friction.

There is no single correct way to split expenses. What matters is that both partners feel the system is fair and sustainable over time.

This article explains common ways couples manage shared bills and how to choose what fits your situation.

Choosing a Bill-Splitting Style That Fits

Couples usually fall into one of three patterns. The right choice depends on income balance, comfort with transparency, and how independent each partner prefers to be financially.

💙 The 50/50 Approach

Split all shared expenses equally regardless of income differences.

✓ Simple and straightforward

✓ Promotes equal partnership feeling

✓ No complex calculations needed

✗ May be unfair with large income gaps

This works best when earnings are similar and both partners are comfortable with identical contributions.

📊 The Proportional Approach

Split expenses based on income percentages or earning capacity.

✓ Accounts for income differences

✓ More equitable for different earners

✓ Reduces financial stress

✗ Requires income discussions

This method supports long-term fairness when income gaps are meaningful.

🔄 The Hybrid Approach

Use different methods for different types of expenses.

✓ Flexible and customizable

✓ Can evolve with your relationship

✓ Balances fairness with simplicity

✗ More complex to manage

Many couples use proportional splits for major costs like rent and equal splits for smaller recurring expenses.

What to Share and What to Keep Separate

Clarity about categories removes constant small negotiations.

🤝 Typically Shared:

• Rent or mortgage payments

• Utility bills

• Groceries and household supplies

• Internet and streaming services

• Home insurance

👤 Often Individual:

• Personal phone bills

• Individual hobbies and interests

• Personal clothing and accessories

• Individual debt payments

• Personal savings goals

Keeping personal categories separate protects independence while shared categories support partnership.

Communication is Key

💬 Monthly Financial Check-ins:

- Review the past month’s expenses

- Discuss any changes needed to your system

- Plan for upcoming large expenses

- Ensure both partners feel the arrangement is fair

Short conversations prevent long-term tension.

Keep Tracking Simple and Visible

Shared visibility reduces misunderstandings. When both partners see the same numbers, discussions stay practical.

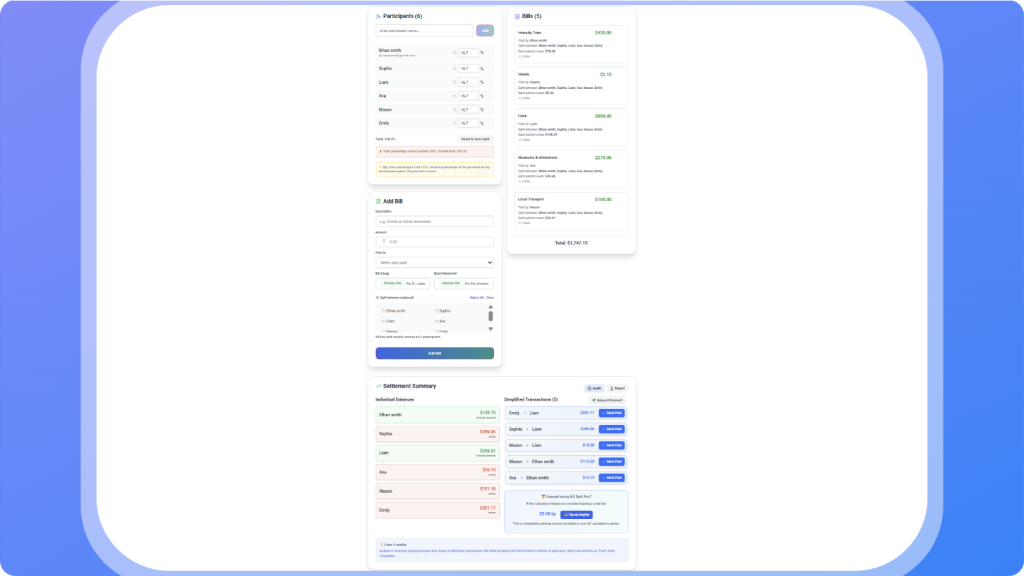

Using a shared bill split calculator can help track recurring expenses, test different splitting methods, and adjust contributions without redoing math each time.

Clarity builds trust. Guesswork does the opposite.

👨🔬

Editor’s Take

"When couples live together, I think shared bills work best when roles are clear from the start. Some expenses can be split 50-50, others can follow income or responsibility. What matters is that both people agree and feel the system is fair." - Martynas Baniulis

Final Words

Shared bills work best when both partners agree on the logic behind them. Equal splits suit some couples. Proportional or hybrid systems suit others.

Talk openly. Revisit the setup when circumstances change. Adjust without blame.

A clear structure turns shared expenses into routine cooperation instead of recurring tension.

💕

Strengthen Your Relationship

Manage shared expenses transparently with Bill Split Pro. Build trust through clear financial communication.